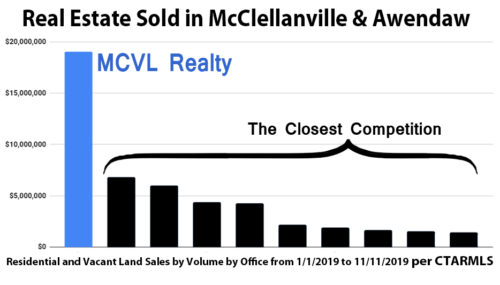

2015 was another fantastic year for real estate in the Bulls Bay area and also for MCVL Realty! We led the area in sales volume, selling 25 sides worth over $5 Million. A majority of these sales came from within McClellanville, where we dominated the market with a 40% share of the dollar volume of sold properties. Daniel Bates was again #1 sales agent in the area by sales volume.

All signs point toward a healthy recover as we climb back to pre- recession sales levels. The chart on the left indicates yearly sales in the region in the last decade and how they are split between McClellan- ville and Awendaw. You will see that Awendaw continues to become a larger part of the market, which I attribute to two major factors. First, Awendaw has grown in size through annexation of more land and has had more growth, so there are simply more listings being logged as “Awendaw”. In fact, the numbers could be even higher depending on whether you were to define Awendaw by zip code, town limits, or rural vs. urban (meaning that many agents will list a property with an Awendaw zip code within the Mt. Pleasant MLS region). The second factor is the growing demographic of buyers that work in Mt. Pleasant and Charleston moving to the area to escape the overdevelopment. These buyers continue to represent the largest driving force in the Bulls Bay real estate market leading me to write the North of “East of the Cooper” article on the following page.

Prices are still below 2005-06 highs, but it is not something that I can indicate on a graph, because the sample size is too small and property prices too varied to produce accurate data. If there were just a few more waterfront or large acreage sales in one year the data would be com- pletely skewed. “Days on market” (or DOM for short), which tracks the number of days between a property being listed for sale and the date that it goes under contract, is also an unreliable measure of the health of the market, because as listings which have been on the market for a long time through the recession finally sell, they register as high DOM’s even though the average new listing is selling faster than in previous years.

As the market has become more stable and sales have increased, one of the factors that I have been watching closely is the amount of inventory for sale in the region. The laws of supply and demand dictate that as the supply of properties decreases and demand increases, the price of properties will also rise. What is interesting in our market is that the number of sales of homes and land in the last 5 years has steadily climbed, however the number of active listings of each has remained very stable (compare graphs to the right). I believe this reflects pent up supply in which sellers were waiting to list their home until the market reached a point at which they were able to recooperate the money they had invested in it. In other words, every time we sell a property and the market values creep up, there is a seller who is ready, willing, and able to fill that empty listing’s place.

When we step back from our market and look at other markets across the nation we may get a glimpse at the future of what’s to come. Most real estate market trends start on the West Coast and in the Northeast and

work toward the Southeast. In some of these markets, they are experiencing a crippling lack of inventory leading to multiple offers over asking price on every new listing that hits the market. Are we there yet? Far from it, but we have started to see certain segments of our mar-ket with very low inventory increase in price rapidly. Acre sized lots in Awendaw and small 2 and 3 bedroom homes come at a premium now. One local builder has capitalized on this by building several spec homes (meaning they are built on speculation, without a buyer at the time construction begins) and had all four under contract before they were finished being built.

The scales are not strongly tipped for buyers or sellers now and it’s a healthy market with a lot of positive signs that it will continue to climb throughout the year. If you are considering buying or selling, give us a call to discuss your specific situation and how we can help you. I’ve talked to a lot of people who sat on the fence too long and let the market pass them by. Don’t let the same happen to you.