528 Pinckney Street, known as “White Gables”, is for sale. This isn’t news, it’s been on the market for over 4 years, but now it is banked-owned and listed by Beach and River Homes and has been reduced to the shockingly low asking price of $150,000. “4 years?”, many people ask. Well yes, but it was introduced to the market at $688,000 when I had a competing home listed for $750K that had been completely remodeled and this home needs a lot of work. Over the years the price just kept dropping along with the market and was listed at $258K most recently before the bank finally foreclosed and slashed the price by over $100K. I’ve shown this house more than any other house in town and have learned that historic fixer-uppers just aren’t for everybody. It is going to take the right buyer even at this price to want to restore National Historic District landmark to it’s former glory. I’d be sure to have at least $100k that you are ready and able to spend on repairs because you just don’t know what you’re going to find once you start opening it up. That being said, $150K is a steal and this house is the buzz of McClellanville. The new owners will surely be the envy of the town and should get used to hearing “We almost bought this home ourselves” on a regular basis.

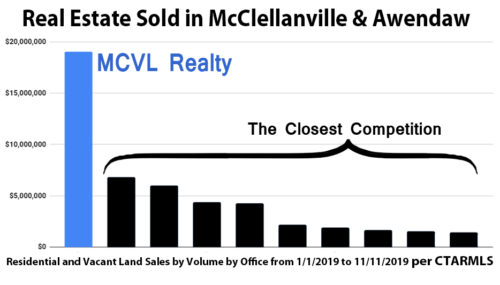

Most people that buy a home do so for their own enjoyment, whether full-time or part-time, but today I wanted to have a discussion about the other side of the coin. Using this home as an example, I want to show the various investment opportunities that one can explore when buying a home. One of the advantages of being the only real estate agent in the area who also specializes in rental management is that I know these markets and the prices that homes can fetch. I should probably disclose that all buyers should do their own research and due diligence and understand that I am using big round numbers for easy math and to make examples. Contact me directly to come up with a detailed analysis of your needs and how a home can work for you.

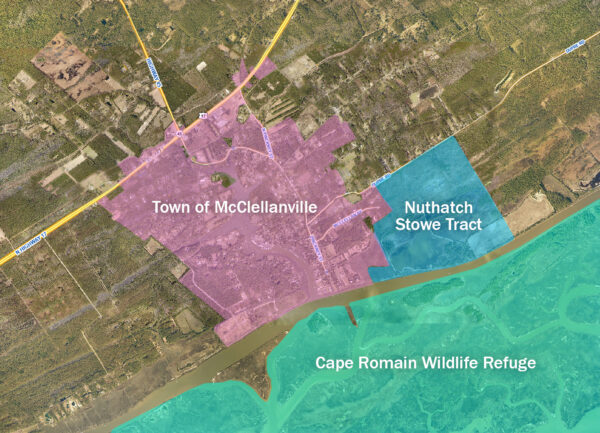

First of all, appraisals aside, they are not making any more road frontage along Pinckney Street in this most historic avenue of homes just down from the boat landing. A vacant 2/3 acre lot such as this would fetch at least $150,000 even in todays market. You get the bonus of a home and a garage on the ground level which can not be duplicated under existing building codes.

The cost to renovate will vary depending on the decisions how far you want to take things, but I think it is safe to say that you’ll want to spend at least $50,000 and probably more like $100,000. Investors should be aware of the rule that does not allow you to spend more than half the value of the home ($75K in this case) on improvements every 5 years without bringing the entire home up to code, which in this case would include the very impractical feat of raising it 10 feet off the ground. You can and should be able to get a variance for this particular home however because most would agree that it is better to restore old homes to protect the essence of McClellanville than to modify or demolish these treasures.

Now let’s look at what could be done with this home. Well, sure, you could live in it, but that’s not very creative. The home is zoned in the historic residential zone which only allows for single family residences, so short of moving your parents or children in with you, that’s not paying any extra bills. So what now?

Flip It

House “flipping” got a bad name 5 years ago when you could turn on TLC or HGTV and every idiot who couldn’t swing a hammer was making $500K on their west coast rehab…fast forward to the present and for some reason California has one of the highest percentage of foreclosures and upside down home ownership, go figure. The numbers look pretty good on this house though. After purchase price, repairs, carrying costs, and real estate commission to sell you’d probably have $275-300K into the home and could hopefully ask $350-400K in return, but every month it’s sitting on the market your profit is counting down. You’ve also put in a lot of hard work and are paying taxes on the profit, so if you’ve already got a nine-to-five it might not be for you.

House “flipping” got a bad name 5 years ago when you could turn on TLC or HGTV and every idiot who couldn’t swing a hammer was making $500K on their west coast rehab…fast forward to the present and for some reason California has one of the highest percentage of foreclosures and upside down home ownership, go figure. The numbers look pretty good on this house though. After purchase price, repairs, carrying costs, and real estate commission to sell you’d probably have $275-300K into the home and could hopefully ask $350-400K in return, but every month it’s sitting on the market your profit is counting down. You’ve also put in a lot of hard work and are paying taxes on the profit, so if you’ve already got a nine-to-five it might not be for you.

Long-term Rental

Well you could also do all the repairs and rent it out long-term and probably fetch about $1200-$1500/month depending on the finishing touches, but that is the top of McClellanville’s rental market (waterfront could fetch more, but are more profitable as short-term rentals) and renters are scarce, but not impossible to find. Your mortgage payments if you financed the purchase and your improvement and are paying taxes and insurance are going to be around $1750, so you’re losing money each month (good investors try to avoid doing this). Combine this with house flipping approach and try to rent while you sell and you may be able to hold out for the perfect buyer, but you’re going to need a patient renter that doesn’t mind showings and a month-to-month lease.

Vacation Rental

Short-term or vacation rentals is also a possibility in this area although most people who want this amount of space want to spend the extra money for waterfront with a dock. If you average $1000/week and figured a conservative 50% occupancy, you’re making about $2200/month but your expenses (including marketing, insurances, taxes, and incidentals) are going to shave that down to around $1500/month but you can count on that occupancy rate to improve each year as you build up return guests.

Short-term or vacation rentals is also a possibility in this area although most people who want this amount of space want to spend the extra money for waterfront with a dock. If you average $1000/week and figured a conservative 50% occupancy, you’re making about $2200/month but your expenses (including marketing, insurances, taxes, and incidentals) are going to shave that down to around $1500/month but you can count on that occupancy rate to improve each year as you build up return guests.

Rent a Portion

There is a provision in McClellanville ordinances that allow for a portion of a home to be rented as long as it is separate and distinct from the home and is under 800 square feet. That means it’s own entrance and kitchen and doesn’t work very well in this home but in the historic district you’re talking about $750/month in rent and you can now live there with a mortgage payment down around $1000.

B&B

The final option that I’ve come up with is to manage the home as a bed and breakfast. McClellanville has supported many different types in the past and truly is the perfect setting for this type of accommodation. The law allows for only 1/3 of the home to be used for the purposes of the guest, which means that 2/3 or more must be split between the owner’s private living quarters or common area for guests. In this home this basically allows for two of the very large rooms to be guests suites. Each suite could rent for $100/night and I think that you could assume 40% occupancy for the first room and 20% for the second which would come out to $1825/month before taxes, marketing, and insurance whittled it down to around $1200, but remember you’ve got the benefit of still having most of the home to occupy as well. Running a B&B (scheduling renters, changing sheets, cooking, entertaining, etc) is certainly not for everyone, but when you figure that each year the return should grow, you could soon be enjoying a mortgage free home it’s not a bad option to have.

The final option that I’ve come up with is to manage the home as a bed and breakfast. McClellanville has supported many different types in the past and truly is the perfect setting for this type of accommodation. The law allows for only 1/3 of the home to be used for the purposes of the guest, which means that 2/3 or more must be split between the owner’s private living quarters or common area for guests. In this home this basically allows for two of the very large rooms to be guests suites. Each suite could rent for $100/night and I think that you could assume 40% occupancy for the first room and 20% for the second which would come out to $1825/month before taxes, marketing, and insurance whittled it down to around $1200, but remember you’ve got the benefit of still having most of the home to occupy as well. Running a B&B (scheduling renters, changing sheets, cooking, entertaining, etc) is certainly not for everyone, but when you figure that each year the return should grow, you could soon be enjoying a mortgage free home it’s not a bad option to have.

Investment property doesn’t have to be the bane of the neighborhood. When properly cared for and managed rental properties of all types can contribute to the overall improvement of an area. Short-term rentals stimulate the local economy without much negative impact (I hope) while long-term rentals allow for a greater diversity of the population such as starter families that may not be financial able to purchase a home but are still involved in local activities. Even if this home slips through your fingers, don’t be afraid to give me a call and let me know what your dreams and aspirations are and I will see what I can find for you.

Update: I received a tremendous outpouring of responses to this article which really shows that the market is not as bad as you hear. I showed the house to two prospective buyers and had many calls from latecomers alas the sellers have accepted a contract and the sale is pending. This contract was actually submitted with 24 hours of the huge price drop although they did wait through the weekend for other offers. The accepted offer was actually for $5,000 above the asking price. The moral of this story is to get your financial ducks in a row because you don’t know when the next deal will come along. You can’t truly be “in the market” for a home if you don’t have a pocket full of money or a pre-qualification letter from a bank.