As I write this report we have yet to have that perfect week with temperatures above 70° that typically marks the official spring real estate rally. In truth, there really hasn’t been a tremendous seasonal slowdown, to speak of. The market just kept humming along right through winter but I expect that we are on the verge of things really heating up just as soon as the temperature does! Despite the political dysfunction in Washington

we’re experiencing record low unemployment and high consumer confidence. The stock market is said to be on the longest bull run in US history with the Dow Jones quadrupling in the last 10 years, but it has wavered in recent months. US real estate markets have also been consistently appreciating during this same 10 year period. Some coastal markets, such as San Francisco, Los Angeles, and New York have seen such rapid appreciation that outpaced wage increases that it has finally led to stagnant growth and even declines in the form of a market correction.

Regionally, the Charleston Metro area has seen healthy market increases led by Mount Pleasant, which has been one of the fastest growing cities in the US since 2009, but it too has been experiencing a market slow down and pricing push-back. Comparing year-to-year sales in Mount Pleasant from 2017 to 2018 we see that the average sales price increased 5% but the number of sales decreased by 8% despite roughly the same amount of new listings in each year.

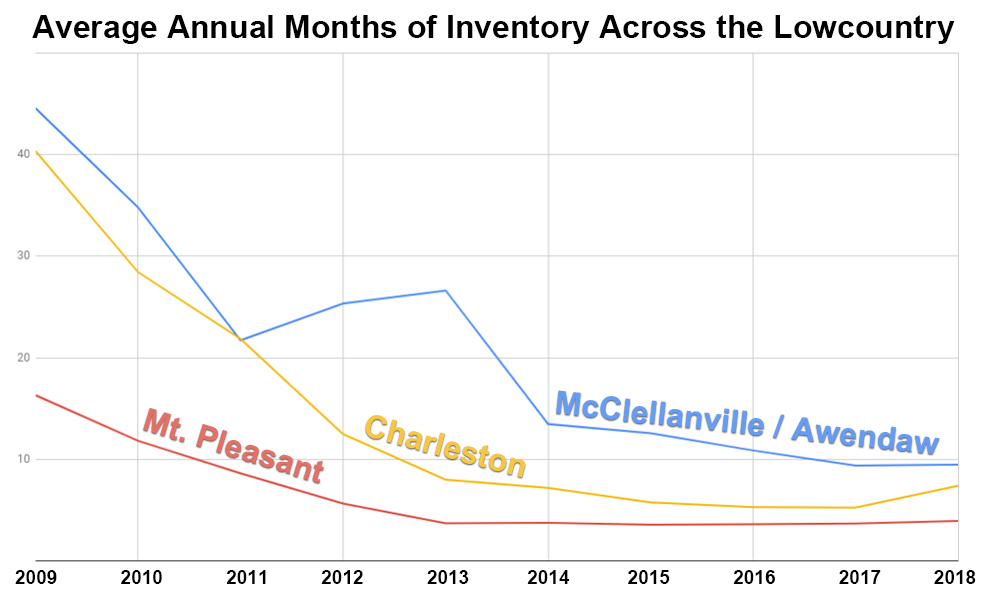

It’s hard to compare markets as diverse in size as Charleston, Mount Pleasant, and McClellanville/Awendaw, but one measuring stick we can use is to look at the number of “months of inventory” in each market. This data takes the total number of listings in an area and divides it by the number of sales in that area in a given month. It’s basically a gauge of supply and demand, so a high number of months of inventory would tell you that there is a large supply of property with limited demand resulting in a buyer’s market. A low number of months of inventory would tell you that the demand is high and indicate a seller’s market. The chart shows the average annual months of inventory in each market over the last decade. In 2009, the market was at its worst and we had a backlog of properties listed for sale and nobody to buy them. As the market improved you can see that all 3 markets saw improving

months of inventory. Charleston leveled off between 2016 and 2017 and then actually increased last year. Mount Pleasant has been ever-so-slightly inching up each of the last 3 years indicating that their market has been slowing down. In McClellanville and Awendaw the number of months of inventory continues to decrease showing a strong and healthy market.

As a sub-market, we often see that our indicators are trailing behind those that we see in the rest of the Lowcountry, which itself is typically trailing major markets on the west coast, Florida and the northeast. The Bulls Bay area has still not fully rebounded to the pre-recession property values, but this moderate “slow and steady wins the race” market appreciation also means that buyers can still find value in our market and that we’re less likely to experience any market corrections. Awendaw continues to show

stability with a balanced market providing land and homes at prices that buyers are willing to pay but clear push-back on

unrealistic listing prices. In McClellanville, the vacant land market has been demonstrating a recent flurry of activity after little growth over the last few years. Home values continue to appreciate with homes under 1500 sq.ft. fetching record prices. In both McClellanville and Awendaw there is a clear favor for newer and updated homes fetching a significantly higher price while homes with deferred maintenance are showing longer days on market to find the right buyer.

The massive growth and change in appearance of Mount Pleasant from a small town to a bustling city has had the unintended consequence of driving a lot of residents out of town. We’ve seen a steady increase in the number of buyers coming from Mount Pleasant to our market over the last 3 years and they now represent roughly half of our buyer pool. They are trading traffic jams for Awendaw Green’s “Barn Jams”, 1/4 acre lots for acreage, and HOA gym cards for back-yard chickens. A strong supply of buyers from a city the size of Mount Pleasant can provide a landslide of

volume for a place with as few listings as McClellanville and Awendaw. These buyers, however, are proving more particular than the average buyer in their preference for turn-key homes with modern finishes. Nearly everyone that we have worked with moving from Mount Pleasant has gained quite a bit of equity in their home and are getting so much more for their money in our market. Should Mount Pleasant experience a market correction it should have little impact on our market because they would still be able to sell for a profit and at the end of the day, Mount Pleasant buyers aren’t moving up or down, they are moving over. They are driven by the fact that they no longer recognize the town they fell in love with.

Another big factor driving sales are the incredibly low interest rates. When I closed on my house last November, I was rushing to lock in an interest rate below 5% and the consensus was that they would keep rising. Fast forward just a few short months and we’re back down in the low 4’s and the Fed chairman has said that there are no plans for rate increases for the rest of the year. Combine these low rates with the high number of buyers in their 20’s and 30’s finding success in the economy and beginning the home-ownership phase of their life and you have a recipe for a successful housing market for the rest of the year.